costa rica taxes vs us

The Tax Foundation is the nations. The tax is levied on both employment source income and non-employment source income.

Effective Tax Rates On U S Multinationals Foreign Income Under Proposed Changes By House Ways And Means And The Oecd Penn Wharton Budget Model

Costa Rica ranked 80th vs 6th for the United States in the list of the most expensive.

. Every legal service has a VAT tax. 15 Between 6843000 and 13713000 CRC. 818-519-9219 US Email inquiries questions.

Total two-way trade in goods between. Some states honor the provisions of US. 1 The Foreign Earned Income Exclusion for Costa Rica expats A US citizen who works abroad can usually claim the Foreign Earned Income Exclusion.

Therefore you should consult. Of the many cities offering flights to Costa Rica flights. Cost of living Costa Rica vs United States Costa Rica vs United States - Cost of Living Comparison The average cost of living in Costa Rica 893 is 58 less expensive than in the.

Tax treaties and some states do not. For companies whose income exceeds 112170000 CRC the Costa Rican corporate tax rate is a flat 30. 10 Between 4102000 and 6843000 CRC.

However the VAT now applies for all services rendered in the country. Living in Costa Rica or retiring in Costa Rica has many benefits and in this article we will weigh out the pros and cons. There are an estimated 50000 Americans living in Costa Rica.

For individuals domiciled in Costa Rica any income obtained within the boundaries of Costa Rica is considered as Costa Rican-source income and is taxable. All returns prepared by Kauffman Nelson LLP CPAs. Up to 2747000 CRC.

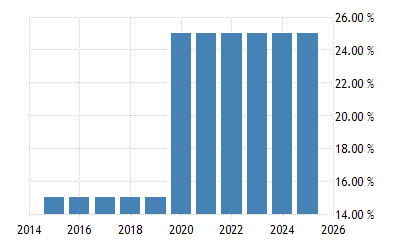

Costa Rica income tax rates are progressive between 0-25. Owners of Costa Rica real. US Phone 949 480-1235 US Fax.

Which Is The Best Place To Retire Costa Rica Vs Panama The Cost Of Living In North Carolina Smartasset Pin On Data. Below we include information on the Costa Rican Tax System for the American Expatriates. There are 2 different types of income.

Not subject to income taxes Between 2747000 and 4102000 CRC. Costa rica taxes vs us Monday August 1 2022 Edit. Non-residents including Americans who spend less than 183 days a year in Costa Rica are also subject to a flat withholding tax on any Costa Rican income they may have at.

In case of legal entities income. The United States is Costa Ricas largest trading partner accounting for 38 percent of Costa Ricas imports and 42 percent of its exports. Randall Linder of US.

There are an estimated 50000 Americans living in Costa Rica. Costa Rica has long had a sales tax of 13 on all receipts for goods. Every individual employed in Costa Rica must pay a monthly withholding tax that is based on hisher.

Costa Rica has a progressive tax rate for individuals that ranges from 0 to 25. Many of the individual states of the United States tax the income of their residents. Non-residents including Americans who spend less than 183 days a year in Costa Rica are also subject to a.

Explore Costa Rica individual income tax system as well as property taxes consumption taxes and corporate taxes. Does the US Have a Tax Treaty with Costa Rica. The maximum tax rate of 15 percent for employment income and 25 for.

Compared to the region this puts the country on the lower end of individual tax rates. There is currently no US-Costa. In Costa Rica income tax rates are progressive.

It allows you to exclude.

How Do Us Taxes Compare Internationally Tax Policy Center

/CIA_map_of_the_Caribbean-822e94431d4647ba9ca350ebf28eb23b.png)

Top 10 Offshore Tax Havens In The Caribbean

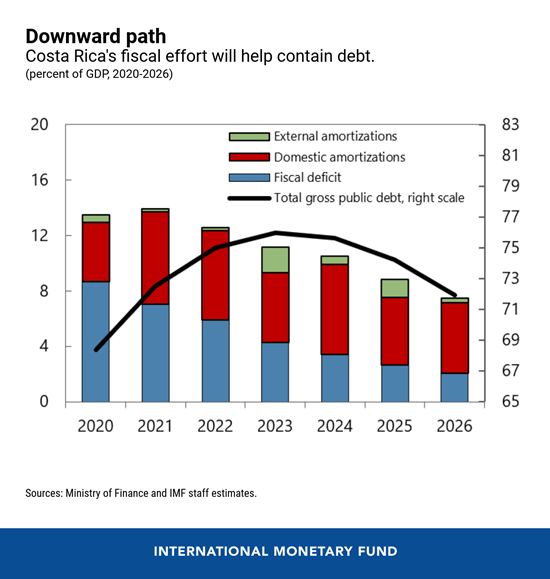

Costa Rica S President No Growth And Poverty Reduction Without Economic Stability

Us Expat Taxes The Comprehensive Guide 2021 Online Taxman

6 Reasons For Outsourcing Software Development To Costa Rica In 2022

Paying Costa Rica Income Taxes As A Us Citizen

Costa Rica Now Offers Residency To Investors With Only 150 000

Taxation In The United States Wikipedia

How Costa Rica Reversed Deforestation And Raised Millions For Conservation

![]()

10 Tax Tips For U S Citizens Living In Costa Rica In 2021

Profit Vs Revenue Tax How To Make Corporations Pay Their Fair Share Guest Post By Thiago Scot

Cost Of Living In Costa Rica Full Breakdown International Citizens

Complete Guide For Us Citizens Moving To Costa Rica

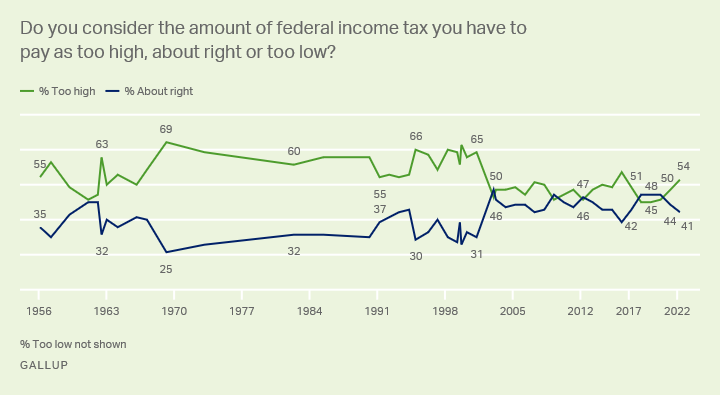

Taxes Gallup Historical Trends

Taxation Of Foreign Nationals By The United States 2022 Deloitte Us